PIR - Individual long-term savings plans

PIR - Individual long-term savings plans

Law no. 232 of 11 December 2016 (budget law for 2017), established Long-Term Individual Savings Plans (PIR). It is a form of investment for household savings aimed at increasing opportunities for small and medium-sized enterprises to obtain financial resources for long-term investments.

Investors (resident individuals), in exchange for duration compliance (at least 5 years) and portfolio composition constraints (at least 70% invested in “qualified” instruments, of which at least 30% issued by small or medium-sized companies), are guaranteed a tax benefit, i.e. total exemption on capital income and on different incomes deriving from the investments made within the "plan".

The growing offer of "PIR compliant" instruments (ETF, PIR Funds), the possibility of investing up to 30% in "free" instruments (corporate bonds, government bonds, etc.), flexibility, clarified by MEF guidelines, in changing the composition of the portfolio while maintaining the right to exemption, are elements that give Banking Institutions significant competitive advantages in their customer offer compared to the static nature of investments offered by asset management companies (with 100% of the invested capital tied up for 5 years in a single fund).

PIR plans can be proposed for asset management or custody and administration accounts.

The value proposition of CAD IT

The application allows the Banking Institutes to manage the fiscal complexity deriving from the role of withholding agent, guaranteeing the client total application of the legal advantages.

Naturally integrated with Finance Area, the module can be used with any financial instrument management procedure and comprises:

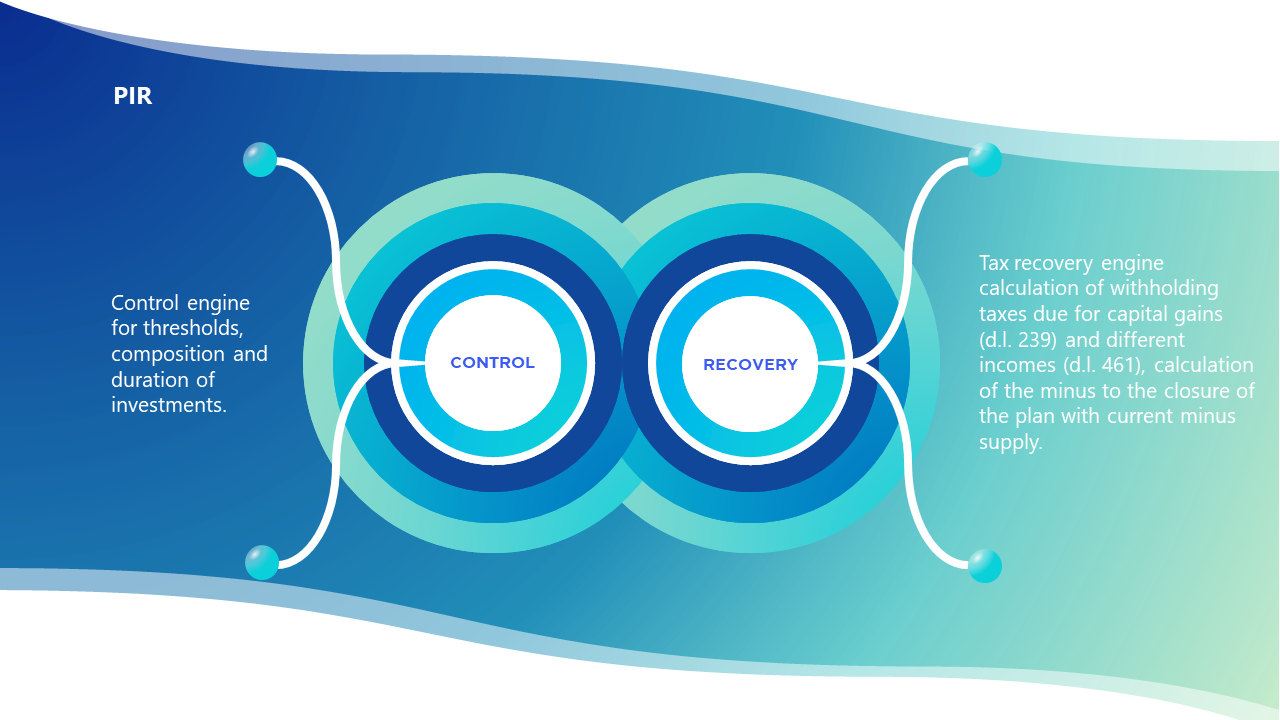

- an investment threshold, composition and duration control engine;

- a tax recovery engine that calculates previous withholdings due to capital gains and other income, with the calculation of capital losses at the end of the plan.

The control engine analyses the handling of PIR reports in order to:

- verify compliance with quantitative limits (threshold check);

- verify compliance with qualitative limits (portfolio composition check, including liquidity);

- verify compliance with concentration limits;

- verify compliance with time requirements (holding period and reinvestment time check);

- report the approaching and exceeding of limits with consequent activation of the tax recovery engine.

The tax recovery engine, based on the reason for its activation, identifies the transactions for which recovery is to be carried out, taking into account:

- the holding period of each instrument;

- the withholdings stored on the movement (including the movement relating to previously abandoned instruments that the instrument in position is replacing, and the relative movements of income deriving from these instruments).

The tax recovery engine applies:

- withholdings on capital income;

- withholdings on different incomes.

The functionalities provided by the PIR Form available to the User are:

- batch loading functions upon transfer from another intermediary;

- management of capital losses;

- monitor for querying active "batches", with evidence of the composition;

- evidence of disposals not yet reinvested with indication of reinvestment deadline and of the taxes that would be charged in the event of failure to reinvest within the established terms;

- monitor for querying any alerts produced by the control engine;

- justification report in case of tax recovery application.

italiano

italiano english

english español

español