Property

Property

The search for a common language in business so that companies can make comparisons at an international level has become a reality with the establishment of International Financial Reporting Standards (IFRS), which have replaced various national rules in Europe and will become the basis on which the entire world will eventually standardise.

As a result of the financial crisis, supervisory organs are continuing to work towards issuing measures (Basel, Solvency) for the prudential regulation of the banking sector and to improve the effectiveness of surveillance actions and the ability of financial institutions to manage the risks they take.

Managing the assets in entity' portfolios is an extremely delicate operation and requires a good knowledge of the markets, careful attention to risk and an accurate analysis of their own portfolio.

The Property module meets the many needs linked to this type of operability.

Property: CAD IT’s value proposition

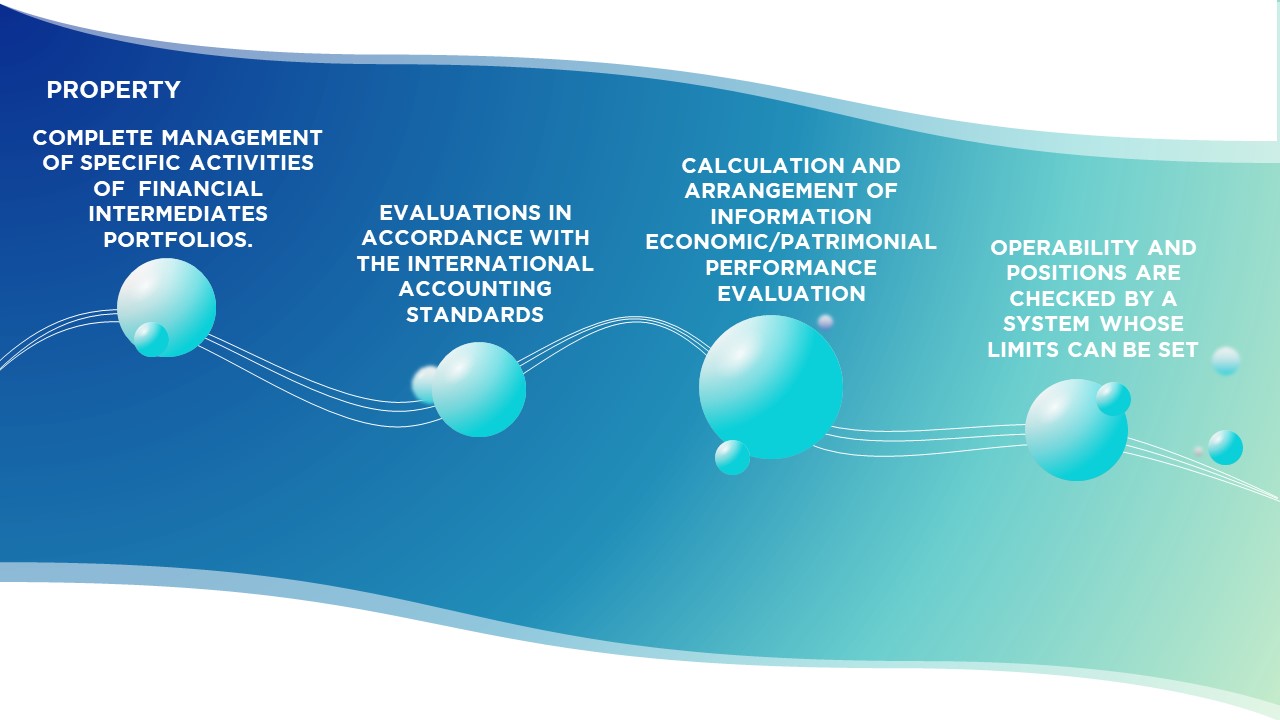

Property manages the specific activities of valuation, reporting and the management of risks and limits linked to financial instruments in financial institution portfolios.

The mudule defines the hierarchical structures of portfolios whose positions may be grouped according to different analysis dimensions.

Benchmarks can be associated to portfolios and financial analyses can be carried out to determine the risks. Projection and simulation functions based on strategic market scenarios defined by the user are also available to check asset risks and to plan interventions.

Main Features

- Verifies respect of the limits in the order input phase and during transactions.

- Manages valuation on the basis of different pricing models.

- Estimates future economic/patrimonial trends in terms of market scenarios and/or possible stress.

- Produces statements and financial statement notes according to IAS principles.

- Provides the users with reports and information query functions.

italiano

italiano english

english español

español