Risk & Compliance

Risk & Compliance

Financial institutions operate in a market context characterised by:

- constant generation of legal regulations;

- increasingly more sophisticated requirements for risk management;

- growing expectations in terms of company reporting.

Facing the themes of risk management, compliance, fraud management and auditing with separate sylos approach can lead to high costs, inconsistent information and an extremely complex system and process governance.

SID: CAD IT’s value proposition

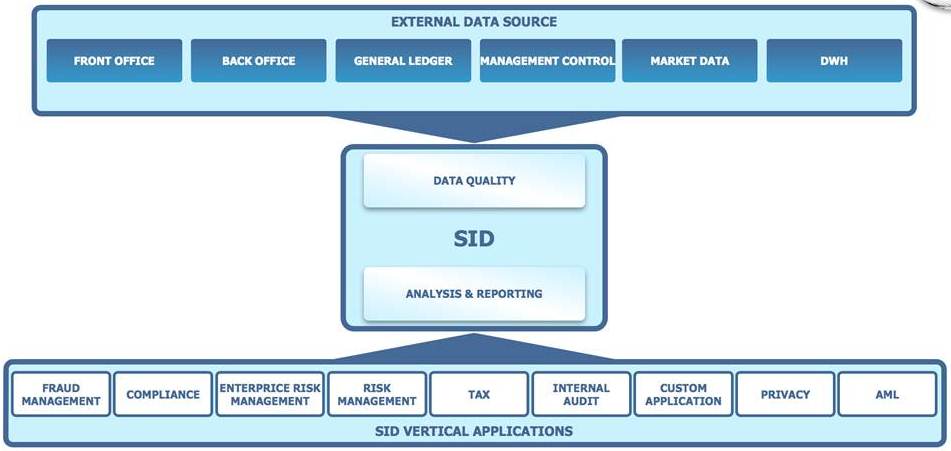

SID is a powerful IT framework designed to manage auditing, risk management and compliance processes in an integrated manner and to be easily adaptable to continual changes.

SID includes application solutions for specific vertical themes which the "general purpose" Business Intelligence systems on the market do not have. Its modular nature means that it can gradually be integrated with other processes while still guaranteeing information consistency and integration, simplifying operability and reducing costs.

Its technical and architectural characteristics were initially designed to allow users to surf their own data freely, produce reports, scenarios and dashboards in total autonomy and with extreme ease without having to depend on the intervention of IT functions.

SID: schema

SID Salient features

- Fast deployment: The system automatically maps the data sources already available in the IT System, thus guaranteeing immediate and safe access and saving downloading and feeding times.

- Fast integration: The environment integrates with the Institution’s existing Systems by means of flexible and powerful Data Management tools able to support large volumes of data.

- Consistent output: Data certification and matching is guaranteed with easy-to-use parametric reconciliation tools.

- Flexible and easy to use: A large number of editing and design tools are available to create Dashboards and interactive pages for data analysis, which the user can personalise in terms of layout and content.

- Sophisticated data access profiles.

- Pre-configured vertical tools: As well as the possibility of implementing applicative custom-made solutions, the System also has a large number of vertical tools designed specifically for the financial sector. These are: Fraud Management, Compliance, Enterprise Risk Management, Risk Management, Internal Audit, Anti Money Laundering, Tax & Privacy.

italiano

italiano english

english español

español